As a regular paying Social Security System (SSS) member, you’re entitled to borrow money to meet your short-term credit needs. The SSS salary loan is a cash loan granted to all SSS members with the total amount you can borrow depending on the number of your contributions. Since you’re technically borrowing your own money, SSS members have two advantages: Approval of loan applications is relatively faster, and the interest rate is significantly lower compared to those offered by non-government institutions. Know more about the SSS salary loan, how you can apply, and the answers to all questions you’ve been itching to ask about this popular SSS program. Related: How to Compute Your SSS Contribution: An Ultimate Guide

In a nutshell, SSS salary loan is a cash loan that SSS members, whether employed or self-employed/voluntary, can use to meet their short-term needs. Due to the fast approval process and low-interest rate, the SSS salary loan is the most popular and most availed program of the Social Security System. In 2019 alone, 29.98 billion worth of SSS salary loans were released and issued to 1.46 million members who availed of the loans from January to September 1 . Related: How to Apply for SSS Unemployment Benefit: An Ultimate Guide

Members who have paid 36 monthly contributions are qualified to avail of the one-month salary loan equivalent to the average of the member’s 12 latest posted Monthly Salary Credits (MSCs), rounded to the subsequent higher MSC, or the amount the member applied for, whichever is lower. Since the maximum Monthly Salary Credit is 25,000, members who pay the maximum monthly contribution can borrow the maximum loanable amount of Php 25,000.

Meanwhile, members who have paid 72 monthly contributions are qualified to avail of a two-month salary loan which is equivalent to twice the average of the member’s posted Monthly Salary Credits (MSCs) in the last 12 months, rounded to the subsequent higher MSC, or the amount the member applied for, whichever is lower. Given that the maximum Monthly Salary Credit is 25,000, members under this category who regularly pay the maximum contribution amount can borrow the maximum loanable amount of Php 50,000.

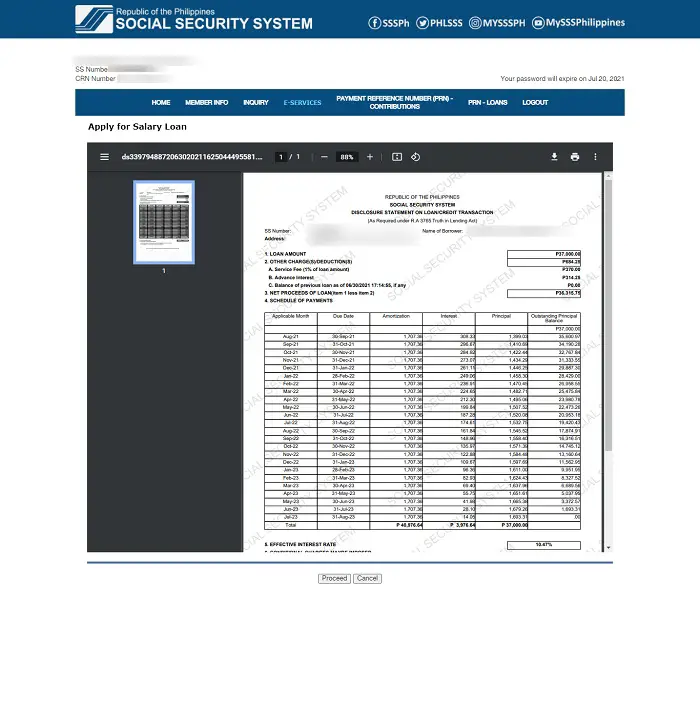

Take note that the final amount will still be subject to deductions. These include the advance interest and a service fee equivalent to 1% of the loan amount. For example, if you’re borrowing Php 37,000, you will only get Php 36,315.75 after deducting the advance interest amounting to Php 314.25 and a service fee of Php 370.

Let’s say you have a monthly income of Php 18,000. Based on the contribution table, your income falls within Php 17,750 – Php 18,249.99, with a Monthly Salary Credit (MSC) of 18,000.

To compute your loanable amount, you must get the average of your latest 12 Monthly Salary Credits (MSCs).

Assuming that your income never changed and you paid your contributions consistently in the last 12 months, the maximum SSS salary loan you can borrow is Php 18,000 for a one-month salary loan and as much as Php 36,000 for a two-month salary loan, provided that you’re qualified for it.

Take note that you can borrow the exact maximum loanable amount or anything lower than that, depending on how much money you need.

From the loan proceeds, a 1% service fee and an advanced interest will be deducted by SSS. On the other hand, if you have an outstanding balance on another SSS short-term loan, it will be deducted from the amount of your approved SSS salary loan.

Per the SSS Circular 2019-014 2 , member-borrowers who want the SSS salary loan must now apply online.

To complete the SSS salary loan application, you need the following:

As of 2021, loan disbursement via check is no longer available. Instead, you can choose from any of the following disbursement methods:

The SSS Circular 2019-014 has made it official that all SSS salary loan applications must now be filed online.

Walk-in application is only applicable to other SSS loans like Calamity Loan Assistance Program (CLAP), Educational Assistance Loan Program (EALP), and Emergency Loan Assistance Program (ELAP).

To know how to file your SSS salary loan application online, follow this step-by-step guide:

Unlike before when there were two My.SSS portals (the old and the new version), now only one website has been consolidated to meet the members’ needs.

Upon landing on the page, you must tick the box “I’m not a robot.” Then, click Submit.

You can choose from three SSS portals: Member, Employer, and Small Business Wage Subsidy Program. Since you’re an individually paying member, click ‘Member’ to access the SSSS member login page.

After entering your user ID and password, verify your identity by ticking the “I’m not a robot” box and click Submit.

In case you’ve lost or forgotten your My.SSS user ID, password, or both, read this article to know how to recover it.

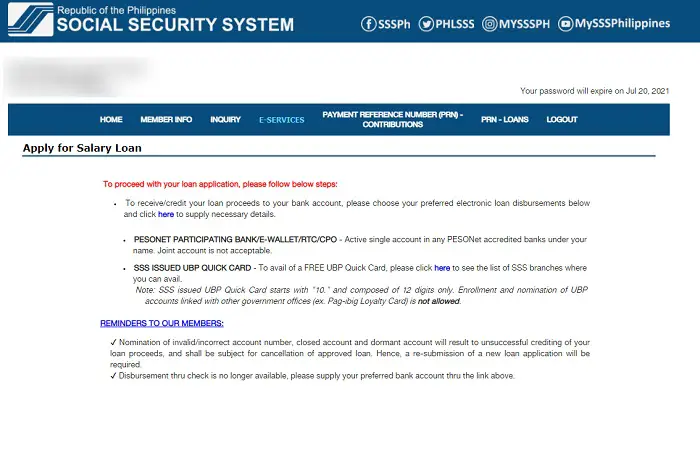

As explained in the previous section, you can receive the loan proceeds through any of the following options:

If you want to get the loan proceeds using either of the first two options, you can enroll your account by clicking the link provided.

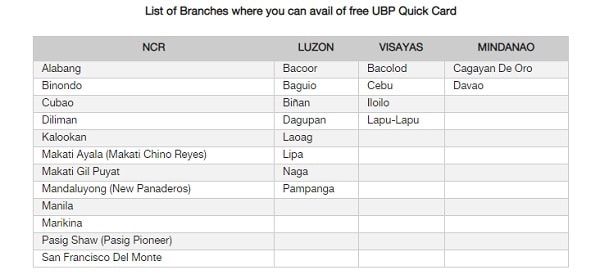

On the other hand, if you want to avail yourself of the free UBP Quick Card, you can proceed to one of the select SSS offices where applications for this card are processed.

As of this writing, disbursement thru check is no longer available.

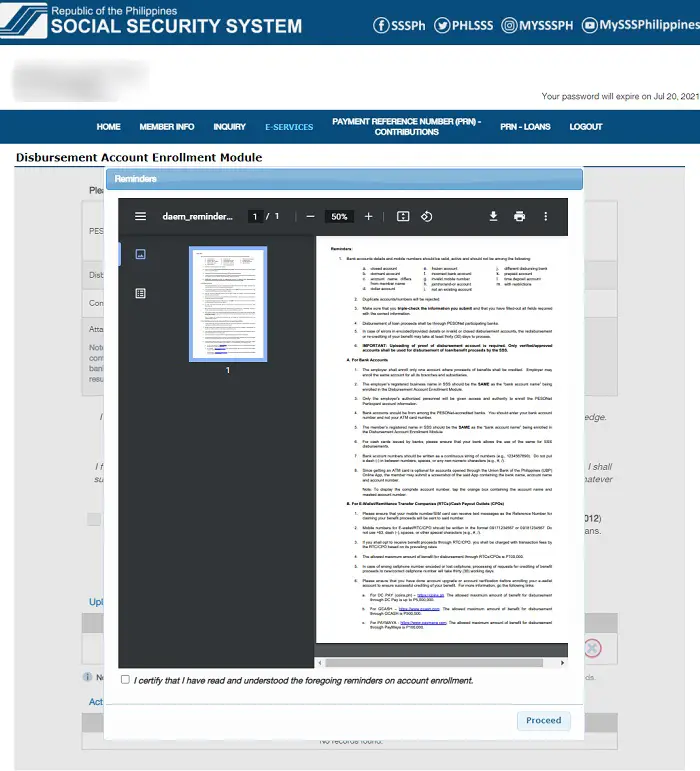

Member borrowers who receive the loan proceeds through either a PESONet-accredited bank account or an e-wallet will be provided a link to the disbursement account enrollment page (see the previous step). After clicking this link, you will be given a copy of the list of reminders related to the Disbursement Account Enrollment Module.

You can give the document a quick read or download a PDF copy. Afterward, tick the box below, “I certify that I have read and understood the foregoing reminders on account enrollment,” then click “Proceed.”

After reading the DAEM reminders, you will then be directed to the main Disbursement Account Enrollment Module, where you can enroll either your bank account or mobile number, depending on your preferred loan disbursement channel.

After providing your bank account details or mobile number, upload a supporting document containing your account name and number. If you’re enrolling a bank account, you can provide a screenshot of your online banking account dashboard, provided it shows your bank’s name, bank account number, and account name, which should be the same as the one provided in your SSS account.

Meanwhile, if you’re enrolling an e-wallet account like a GCash account, provide a screenshot of your mobile app account showing your complete name and account number.

Once all the essential details are provided, tick the box to permit SSS to use your personal information. Finally, click the “Enroll Disbursement Account” button.

The servicing branch will receive your submitted supporting documents and send you an update within 1 to 2 working days.

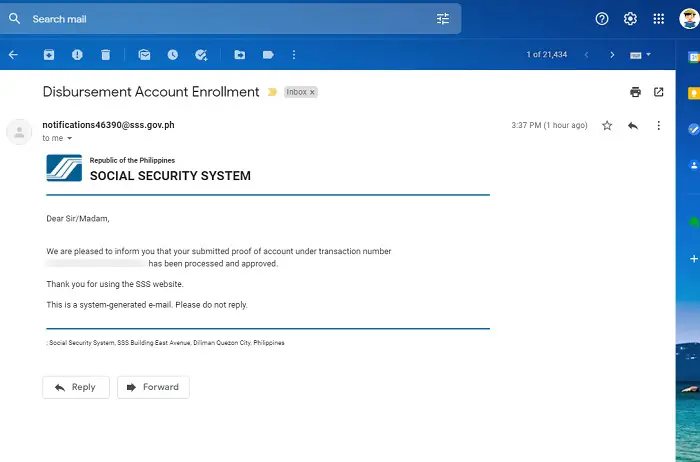

If your Disbursement Account Enrollment is approved, you will receive an email and SMS notification informing you that the submitted proof of account has been processed and approved.

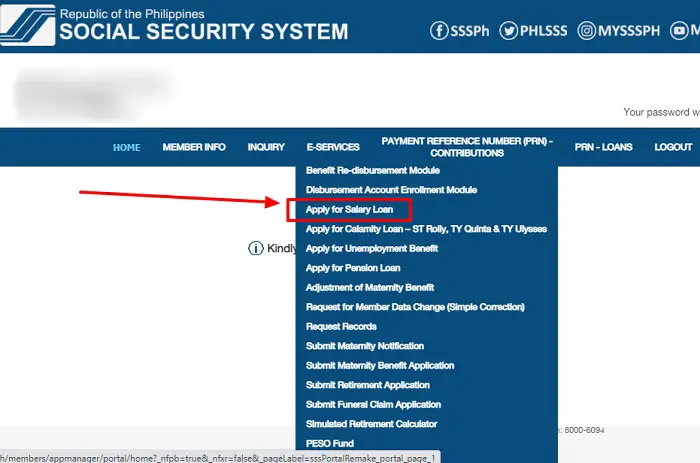

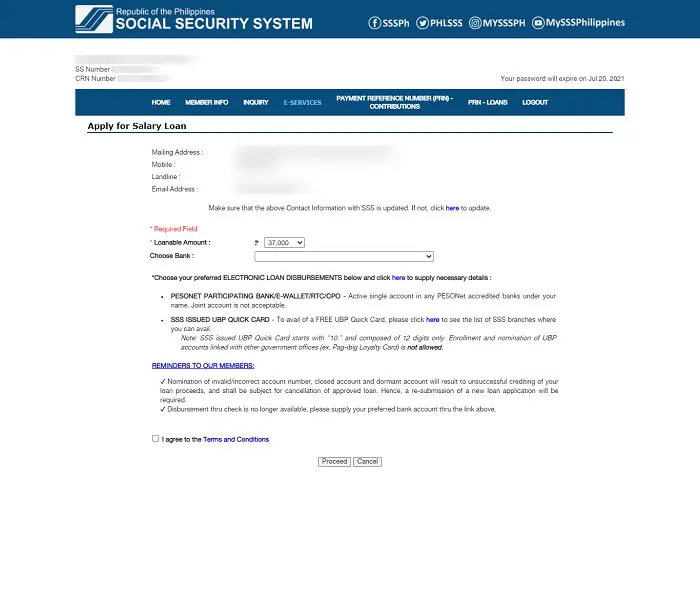

Now that your disbursement account has been approved, go back to your My.SSS account and click “Apply for Salary Loan” under E-SERVICES.

Double-check if your mailing address, mobile number, landline, and email address are updated. If not, click here to update or change your account information.

Then, select the amount of salary loan you need. Take note that the maximum loanable amount will be automatically displayed. If you want to borrow a smaller amount, click the drop-down menu and select the exact amount that meets your current needs.

After selecting the amount you want to borrow, choose how to claim the loan proceeds. Since you already enrolled your disbursement account, select the exact bank account or e-wallet account you enrolled in using the drop-down box provided.

After reading a few reminders, check the “I agree to the Terms and Conditions” box and click “Proceed” to go to the next step.

The Loan Disclosure Statement contains a summary of all the essential information about your SSS salary loan, including:

After reviewing the content of the Loan Disclosure Statement, click Proceed.

Review the ‘Certification, Agreement, and Promissory Note‘ and click ‘Submit.’

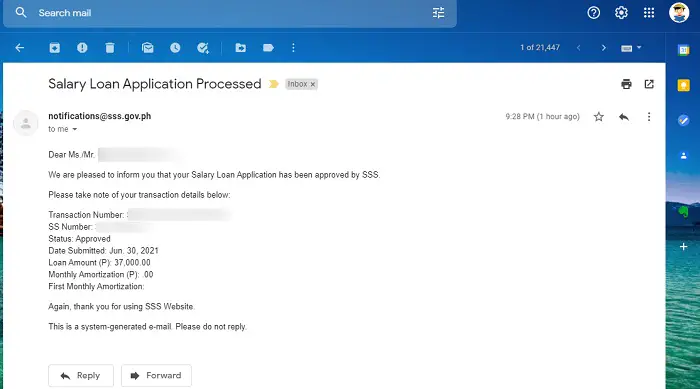

Keep a copy of the transaction number for future reference. A confirmation message showing the same transaction number will also be sent to your email address.

After submitting your salary loan application online, please take note of the following:

For employees: Your employer will be given three working days to certify (reject/approve) your salary loan. Once this step has been completed, you will then be notified either via email or SMS about the status of your application;

For separated, self-employed, OFW, and voluntary members: You will also be notified through email or text whether your loan application has been approved.

Once the loan proceeds are ready, member-borrowers can claim it through their preferred mode. For more information, read this.

Based on my personal experience, loan proceeds were credited to my bank account within two days after receiving an email from SSS saying that my application was approved.

Member borrowers who have opted for electronic loan disbursement should receive the loan proceeds within 8-10 working days.

For member-borrowers who have opted to receive the loan proceeds via mail, the check will be sent to their registered mailing addresses by PHILPOST within 7-10 working days for those in NCR and 10-15 working days for those who live outside NCR.

If you’re employed, the check can be picked up by your authorized company representative; otherwise, the check will be sent to your employer’s address. Voluntary/self-employed members, meanwhile, will have their checks delivered to the local mailing address indicated in their application.

Note that after check generation, handling and delivering these SSS salary loan checks now falls under the jurisdiction of PHILPOST. If you have questions about the delivery schedules, you might also want to reach out to PHILPOST.

Update: Disbursement of loan proceeds via check is no longer available as of 2021.

For OFWs who currently live and work abroad, you can direct your questions/concerns to the OFW Program Management Department of SSS through the email address [email protected]

The processing time is significantly longer during events that require SSS offices to be closed temporarily or indefinitely.

There are four ways to check the status of your SSS salary loan application: Via SMS, online through the SSS Member Portal, via email, or over the phone.

a. Via Text Message

To check the status of your loan application via SMS, you must first register with the TEXT-SSS by typing in SSS REG SS number> and then sending it to 2600 (see photo below for example).

Once registered, you will receive a Personal Identification Number (PIN) which you’ll need every time you make any SSS-related inquiries via text message.

To view the status of your SSS salary loan, for example, just key in SSS and send it to 2600.

b. Online through the SSS Member Portal

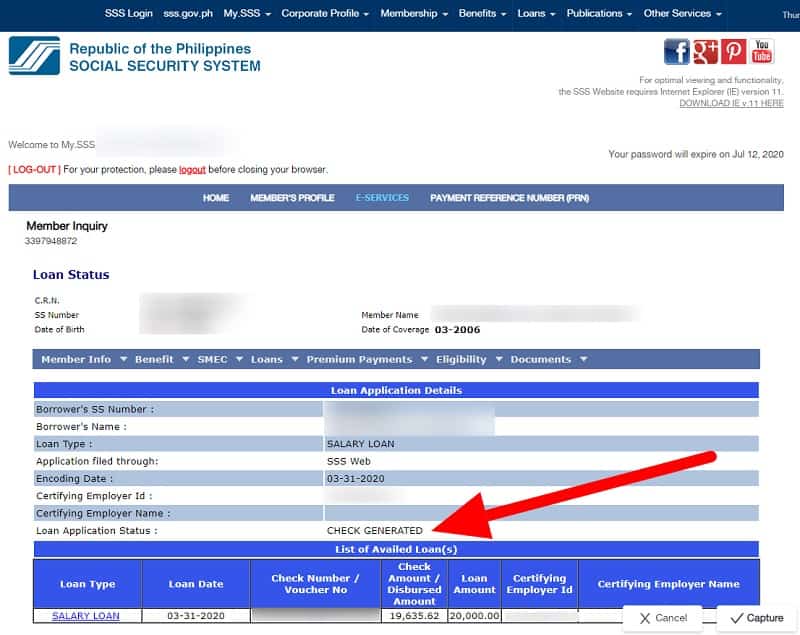

A relatively more straightforward way to check SSS loan status is by logging in to the SSS member portal.

Once inside the portal, point the cursor to ‘E-SERVICES’ and click ‘Inquiry.’ A page showing details of your membership will be displayed. From the list of options on the menu, point your cursor to ‘Loans,’ and a drop-down menu will appear. Click ‘Loan Status/Loan Info’ to show the details of your current loan application.

In my case, my SSS salary loan application status at the time of checking is “CHECK GENERATED,” meaning the check is already available and ready to be delivered/credited to my account.

c. Via SSS Hotline

Another way to check the SSS loan status is over the phone. The SSS hotline is 1455 at 1-800-10-2255777, toll-free.

d. Via Email

If all else fails, you can also send an inquiry to the Member Communications and Assistance Department of the SSS at [email protected]

For OFWs, the email address where you will send your inquiry is [email protected]

Member borrowers with approved SSS salary loan applications can claim their loan proceeds electronically through their enrolled disbursement account. As soon as the loan proceeds are available, they will be credited to your PESONet-accredited bank account, e-wallet, or SSS-issued UBP Quick Card, depending on which type of disbursement account you’ve chosen. Based on my experience, loan proceeds are released within 2 to 3 days after SSS sends you an email notification that your loan application has been approved.

If you’re moving to a new employer and haven’t fully paid your loan obligations yet, you must notify both the SSS and your new employer.

First, proceed to the Member Services Section of any SSS branch office near you and notify them that you’re changing your employer. This notice should include your name, SSS number, and signature. You can inform them through mail or email as well.

Meanwhile, your new employer can make the necessary arrangements to deduct your monthly amortizations, including interest and penalty for late payments, from your salary. All you need to do is to submit to your new employer an updated statement of account of your outstanding SSS salary loan.

Under the new guidelines by the SSS, member-borrowers can now renew their SSS salary loan provided that they have paid at least 50% of the original principal amount and at least 12 months or 50% of the loan term has lapsed.

For example, if your salary loan amounting to PHP 37,000 was approved on June 30, 2021, you can only apply for another salary loan once your principal loan balance is less than PHP 18,500 (50% of PHP 37,000). On the other hand, the renewal date should only be after July 2022.

Proceeds of the renewal loan can be greater than or equal to zero, provided that the outstanding balance of the previous salary loan has been deducted from the new loan.

Yes. Employed, self-employed, and voluntary SSS members can use all avail of the salary loan as long as they meet these other qualification requirements set by the SSS:

a. Must not be older than 65 years old at the time of application;

b. Must meet the contribution requirement, which is at least 36 monthly contributions, six months of which have been paid within the last 12 months before salary loan application;

c. Must not be a beneficiary of any final SSS benefits like retirement and total permanent disability benefit;

d. Must have a clean record and never committed fraud against the SSS.

OFWs abroad who regularly pay their monthly SSS contributions either in full or with their employers’ share of contribution are qualified to avail of the SSS salary loan provided that they meet these requirements:

a. Must not be older than 65 years old at the time of application;

b. Must have paid at least 36 monthly contributions, six months of which have been paid within the last 12 months before the salary loan application;

c. Their employers must be updated in terms of the member’s paid contributions and loan remittances;

d. Must not be a recipient/beneficiary of any final SSS benefit like death, retirement, and total permanent disability benefit;

e. Has never been disqualified due to fraud committed against the SSS.

You can now proceed with the SSS salary loan online application if you meet all the qualification requirements above. Unlike before, when OFWs could still file their loan applications personally at SSS offices, all SSS salary loan applications must now be filed online. Hence, without an online My.SSS account, you won’t be able to apply for an SSS salary loan.

If you don’t have an account yet, no problem. You can read and follow this step-by-step guide to SSS online registration.

After creating an account, you may log in to file your salary loan application. For the sake of convenience, here’s an overview of how you can apply for an SSS salary loan online if you’re an OFW abroad:

Step 1: Go to the new SSS website and access the Member portal;

Step 2: Log in to your My.SSS account with your user ID and password. You can request a password reset if you’ve lost or forgotten either of the two;

Step 3: Click the ‘E-SERVICES’ on the main menu and select ‘Apply for Salary Loan’;

Step 4: Select the amount you want to borrow and choose how to claim or receive the loan. If you have a UnionBank savings account or other savings account accepted by the SSS, you will be provided a link to enroll your bank account. Alternatively, you can click the ‘E-SERVICES’ again and then select ‘Bank Enrollment’;

Step 5: Read the Loan Disclosure Statement;

Step 6: Wait for the email notification from the SSS confirming that your loan application has been approved and is now ready for release.

In case you’re having trouble with the online application, or if you have other SSS concerns, you may reach out to the OFW Program Management Department of the SSS through this email address: [email protected]